capital gains tax canada exemption

Lifetime capital gains exemption limit. Then transfer the amount from line 19900 of that schedule 3 to line.

2016 Federal Budget Commentary Pacific Spirit Vancouver Financial Advisors Wealth Management

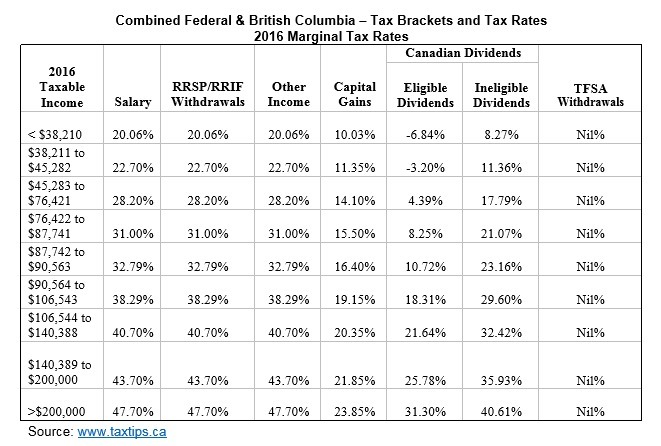

And the tax rate depends on your income.

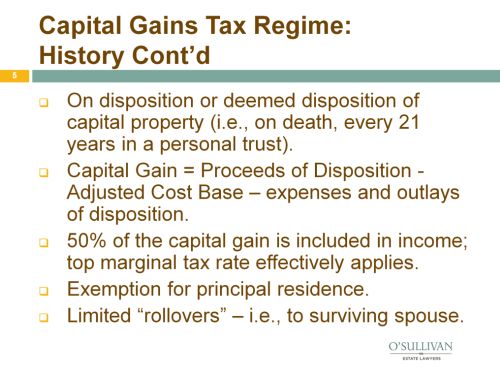

. If your capital gains are 100000 you will be subject to a capital gains tax on 50000. However seeing as the LCGE allows you to subtract 913630 from your profits in 2022 you only pay taxes on 950000 - 913630 x 50 18185 rather than on 475000. The sale price minus your ACB is the capital gain that youll need to pay tax on.

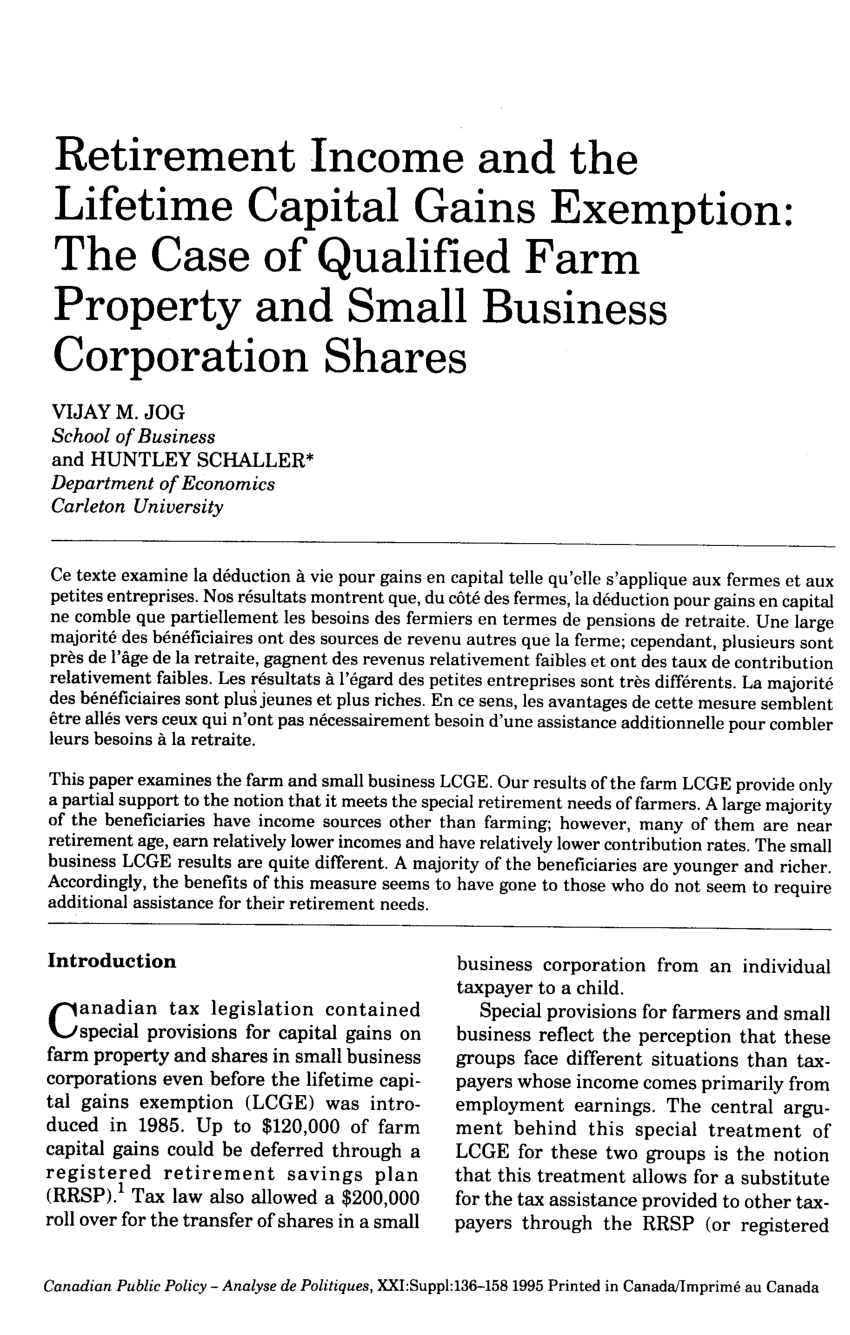

For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased. The lifetime capital gains exemptions LCGE is helpful for small business owners and their family members allowig them to avoid paying taxes on capital gains income up to a. For the purposes of this deduction the CRA will also consider you to.

For a Canadian who falls in a 33 marginal. An eligible individual is entitled to a cumulative lifetime capital gains exemption LCGE on net gains realized on the disposition of qualified propertyThis exemption also. The capital gains deduction can be applied against taxable capital gains included in 2021 income that arose from.

Since its more than your ACB you have a capital gain. Residential Indians between 60 to 80 years of age will be exempted. An individual will be exempted from paying any tax if their annual income is below a predetermined limit.

If you sold property in 2021 that was at any time your principal residence you must report the sale on Schedule 3 Capital Gains or Losses in 2021 and Form T2091IND Designation of a. Exemptions on Capital Gains Tax for Donations. In this article we outline the history of capital gains taxation in Canada describe some of the key.

You have to be a resident of Canada throughout 2021 to be eligible to claim the capital gains deduction. Dispositions of qualified small business corporation shares. Stress test results by age chart.

The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal. Akin to Section 112A Section 111A specifies the rate of capital gain tax to be 15 plus applicable surcharge and cess on the gains arising from the transfer of a short-term. This means that if you earn 1000 in capital gains and you.

However the Income Tax Act ITA allows. Land rover dtc 32. To claim the capital gains exemption first complete Schedule 3 to calculate your capital gains for the year.

Zoldyck family x child reader. On a capital gain of 50000 for instance only half of that amount 25000 is taxable. Is there a one-time capital gains exemption in Canada.

Investors pay Canadian capital gains tax on 50 of the capital gain amount. Lifetime Capital Gains Exemption LCGE LCGE is claimed against the income included under Capital gains from the eligible property by an eligible taxpayer. How much tax do you pay on capital gains in Canada.

The amount of the exemption is based on the gross capital gain that you make on the sale. A taxpayer who sells his or her principle residence which is defined in the ITA becomes liable for paying tax on the capital gains. January 1 2022 marks the 50th anniversary of the capital gains tax in Canada.

Hernia belt for running. Your sale price 3950- your ACB 13002650. The capital gains exemption.

However since only 50 percent of any capital gain is taxable in Canada the actual.

The Huge Tax Break For Home Sellers What To Know About The 500 000 Exemption Wsj

Pdf Retirement Income And The Lifetime Capital Gains Exemption The Case Of Qualified Farm Property And Small Business Corporation Shares

Claiming The Lifetime Capital Gains Exemption Lcge 2022 Turbotax Canada Tips

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Do You Have To Pay Capital Gains Tax Expat Us Tax

Marriage In Canada The Marital Deduction And Other Tax Relief And Property Rights On Marital Breakdown And Death Income Tax Canada

Taxtips Ca Business The 400 000 Lifetime Capital Gains Deduction Is 1 2 Of The 800 000 Lifetime Capital Gains Exemption

Finance Proposals On Tax Planning Using Private Corporations Income Splitting And Lifetime Capital Gains Exemption Deloitte Canada

Canada Capital Gains Tax Calculator 2022

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Infographic Lifetime Capital Gains Exemption Qualified Small Business Corporation Cardinal Point Wealth Management

Farmers And The Alternative Minimum Tax Baker Tilly Canada Chartered Professional Accountants

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Avoid A Tax Nightmare Capital Gains Tax On Your Principal Residence I New Rules Youtube

How The Lifetime Capital Gains Exemption In Canada Works Lcge Youtube

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

Capital Gains Tax Exemption Made Easy In Canada Youtube

United States Taxation Of International Executives Kpmg Global